Rare Earths

Rare Earth Elements: Small Market, Big Necessity

Compared to similarly-abundant elements in nature, such as copper, lead, and tin, global annual production of rare earth elements is notably low. Nevertheless, rare earth elements have become critical enablers of technologies at the heart of clean energy initiatives worldwide, as well as ubiquitous gadgetry and electronics that have pervaded modern society.

Rare earth elements are used in small, but often necessary, amounts in hundreds of different technologies, materials, and chemicals worldwide in commercial, industrial, social, medical, and environmental applications.

In just a period of decades, rare earth elements have seeped deeply into the fabric of modern technology and industry and have proven exceptionally challenging to duplicate or replace.

Terminology and Abbreviations

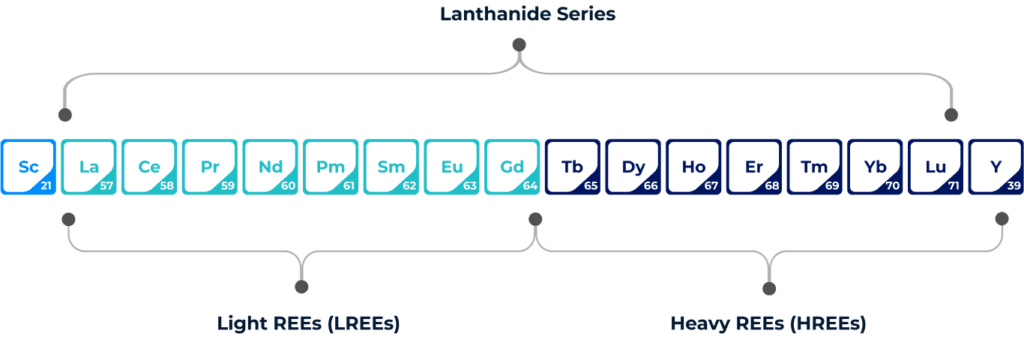

On the Periodic Table of Elements, rare earth elements include the lanthanide series, plus yttrium and scandium (see Figure 1).

Yttrium is classified as a rare earth element because of its similar ionic radius to the lanthanides, as well as its similar chemical properties, whereas scandium is classified as a rare earth element because of its tendency to concentrate into many of the same minerals.

FIGURE 1 : Rare earth elements include the lanthanide series plus scandium and yttrium.

Rare earth elements are arbitrarily classified as light rare earth elements or oxides (LREEs or LREOs) or heavy rare earth elements or oxides (HREEs or HREOs) based on their electron configurations. Simply put, LREEs have an increasing number of unpaired electrons in their 4f shells, starting at lanthanum, which has zero unpaired electrons, through to gadolinium, which has seven unpaired electrons.

HREEs, on the other hand, have paired electrons – a clockwise and counter-clockwise spinning electron. Yttrium’s physical properties and chemical reactivity resemble those of HREEs, thus it is categorized as such.

Rarely Enriched in Nature

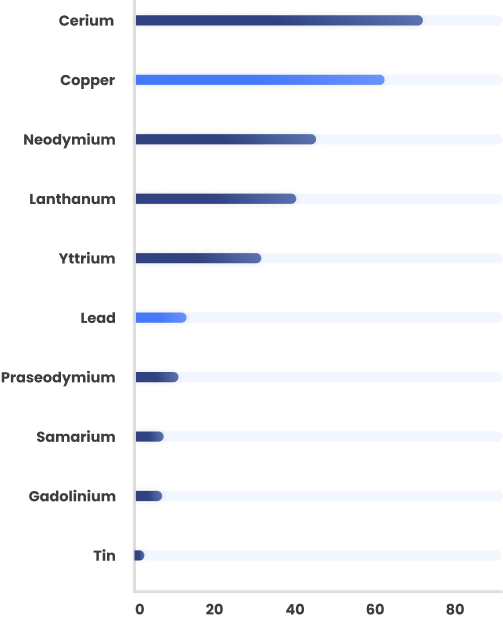

Despite this fact, only 254,000 tonnes of all 17 REOs combined (TREOs) were produced globally in 2021 versus 21 million tonnes of copper, 4.3 million tonnes of lead, and 300,000 tonnes of tin in the same year (see Figure 2 – RHS).

Crustal Abundance

Parts per Million

2021 Global Production

Tonnes (millions)

FIGURE 2 : Global production of REEs is remarkably low compared to similarly – abundant elements.

Compliant Mineral Reserves by Region

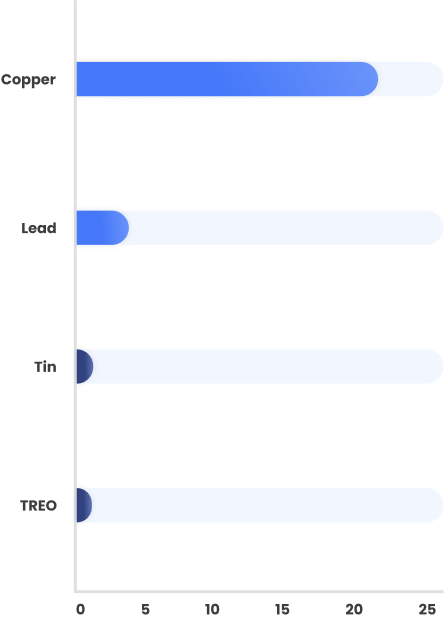

Globally, there are 17 compliant rare earth Mineral Reserves located in 10 nations on five continents. All of the Mineral Reserves were estimated within the last fifteen years and comply with National Instrument 43-101 (“NI 43-101”) or Joint Ore Reserves Committee (“JORC”) standards of disclosure for mineral projects, or South African Code for the Reporting of Mineral Resources and Mineral Reserves (“SAMREC”).

The 17 compliant Mineral Reserves collectively amount to 694.86 Mt of mineralized material containing 1.22 wt. % TREO, equal to 8.49 Mt of TREO in-situ (see Figure 3).

By virtue of the numerous advanced rare earth projects it hosts, Australia’s five rare earth Mineral Reserves contain 30% of the world’s in-situ TREO hosted in compliant Mineral Reserves. Owing to its large mass, Greenland’s one rare earth Mineral Reserve holds 18% of the world’s in-situ TREO contained in compliant Mineral Reserves.

Similarly, the U.S.’ two rare earth Mineral Reserves also contain 18% of the world’s in-situ TREO hosted in compliant Mineral Reserves.

Tanzania’s single rare earth Mineral Reserve hosts 10% of the world’s in-situ TREO contained in compliant Mineral Reserves, and South Africa’s two Mineral Reserves host an additional 10% (see Figures 3).

Brazil’s one rare earth Mineral Reserve hosts 6% of the world’s in-situ TREO contained in compliant Mineral Reserves, and Canada’s two rare earth Mineral Reserves contain 4% of the world’s in-situ TREO contained in compliant Mineral Reserves.

Lastly, Sweden’s one rare earth Mineral Reserve, Malawi’s one rare earth Mineral Reserve, and Chile’s one rare earth Mineral Reserve host 2%, 2% and 0.1%, respectively, of the world’s in-situ TREO contained in compliant Mineral Reserves (see Figures 3).

FIGURE 3 : Compliant global rare earth reserves base by nation.

Source: Adamas intelligence research (2019).

Non-Compliant Mineral Reserves by Region

Non-compliant rare earth mineralization has been abundantly documented and is often referred to as “resources” or “reserves” by the media or other industry stakeholders, fostering confusion as to what the terms ‘resources’ and ‘reserves’ refer to in any given instance.

Moreover, practices exist for estimating “undiscovered mineral resources”, such as that defined by Singer and Menzie (2010), and are used by the U.S. Geological Survey (“USGS”) and other industry tracking organizations to assess and estimate national information on mineral reserves worldwide. Because comprehensive evaluations that apply the same set of criteria to deposits in all geographic areas are not conducted, industry tracking organizations, such as the USGS and Geoscience Australia, utilize a combination of national resource/reserve estimates compiled by countries, as well as assessment information provided by governments, academic articles, company reports, presentations, trade journal articles, and other seemingly-reliable sources of information to estimate national and global resource and reserve bases.

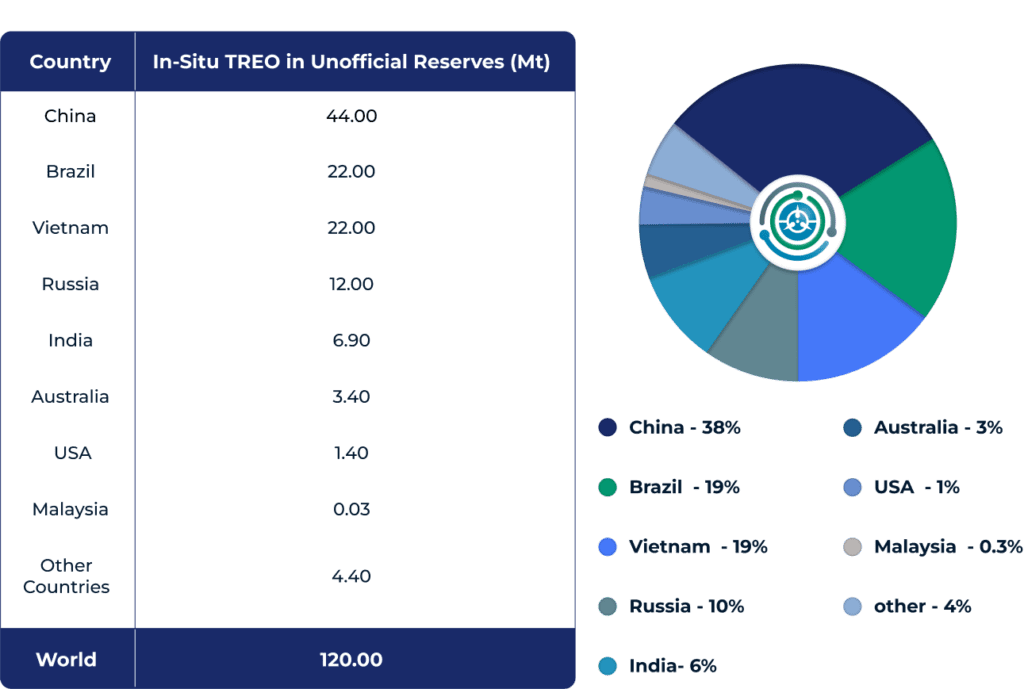

The global reserves base estimated by the USGS (see Figure 4) amounts to 120.00 Mt of in-situ TREO, including 44 Mt of non-compliant in-situ TREO in China, 22 Mt of non-compliant in-situ TREO in Vietnam, 12 Mt of non-compliant in-situ TREO in Russia and around 7 Mt of non-compliant in-situ TREO in India, suggesting the USGS estimates only account for a maximum of 35 Mt of in-situ TREO contained in compliant Mineral Resources and/or Mineral Reserves.

Of the 120.00 Mt of in-situ TREO estimated by the USGS to exist in mineral reserves globally, 38% is estimated to be in China, 19% is estimated to be in Brazil, 19% is estimated to be in Vietnam, 10% is estimated to be in Russia, 6% is estimated to be in India, 3% is estimated to be in Australia, 1% is estimated to be in the U.S., and the remaining 4% is estimated to be hosted in “other countries”, presumably dominated by Canada and Greenland (see Figure 4).

FIGURE 4 : Non-compliant global rare earth reserves base by nation.

Source: SUGS 2019 rare earths mineral commodity summary.

Global Rare Earth Production in 2018

In 2018, we estimate that global mine production of TREO (and TREO equivalent) amounted to 184,000 tonnes – an increase of 21% over the year prior due to substantial production hikes in China, Myanmar and the U.S.

Despite possessing just 38% of the world’s non-compliant rare earth reserves, Adamas Intelligence estimates that China was responsible for 68% of global primary TREO production in 2018 (and nearly 100% of global secondary TREO production), Myanmar was responsible for 11%, Australia was responsible for 10%, the U.S. contributed 9%, and 2% came from other nations (see Figure 5). Moreover, we estimate that light rare earth oxides (“LREOs”) made up 90% of global primary TREO (and TREO equivalent) production in 2018 and heavy rare earth oxides (“HREOs”) made up the remaining 10% – nearly all of which was mined and processed in China.

In total, we estimate that the value of global primary TREO (and TREO equivalent) production amounted to US $3.24 billion in 2018, an increase of 13% over the value produced the year prior.

FIGURE 5 : Global primary TREO production share by country in 2018.

Source: Adamas Intelligence research.

Eight End-Use Categories

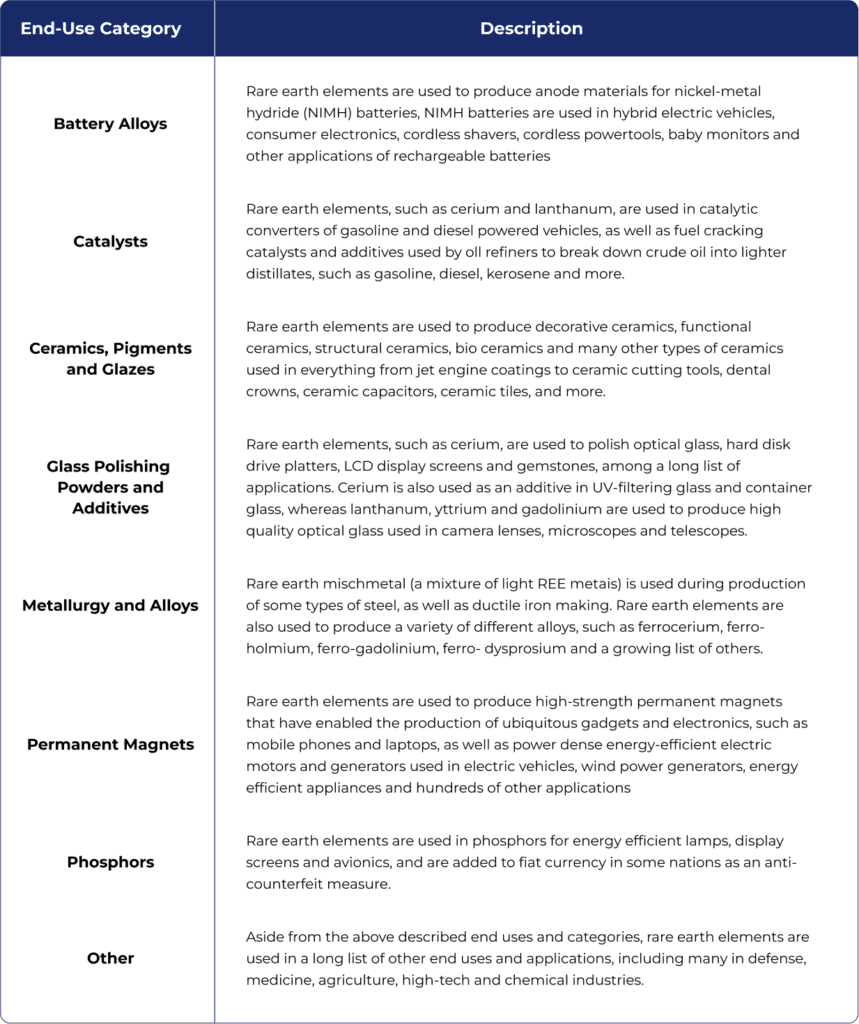

Rare earth elements are used in hundreds of unique end-uses and applications that collectively fall into one of eight end-use categories: 1.) Battery Alloys, 2.) Catalysts, 3.) Ceramics, Pigments and Glazes, 4.) Glass Polishing Powders and Additives, 5.) Metallurgy and Alloys, 6.) Permanent Magnets, 7.) Phosphors, and 8.) Other End-Uses and Applications (see Figure 6).

FIGURE 6 : Rare earth applications and end-uses fall into one of eight end-use categories.

Source: Adamas Intelligence research.

Global Rare Earth Consumption in 2018

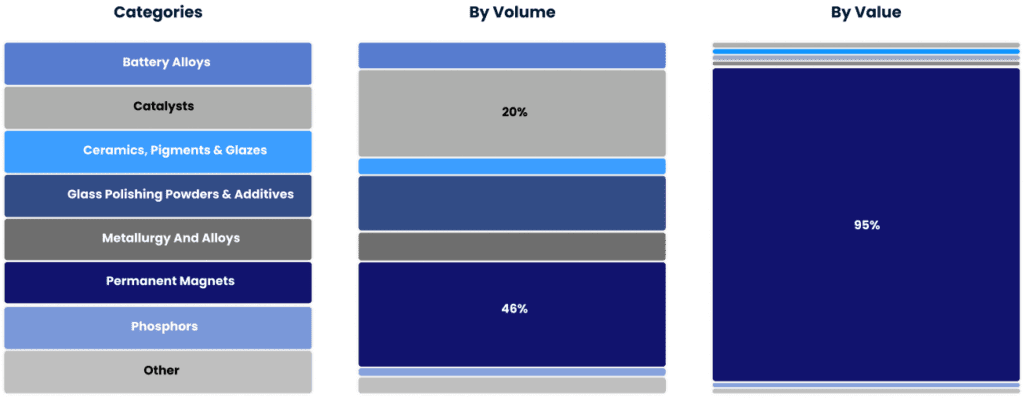

By volume, permanent magnets and catalysts were collectively responsible for over 65% of global TREO consumption in 2021 (see Figure 7). However, by value, permanent magnets alone were responsible for over 95% of the total value of global TREO consumption in 2021 (see Figure 7) and this share is poised to expand further as demand (and prices) for neodymium, praseodymium, dysprosium and terbium continue to rise strongly in the years ahead.

FIGURE 7 : permanent magnets and catalysts are the largest rare earth demand drivers.

Source: Adamas Intelligence research.

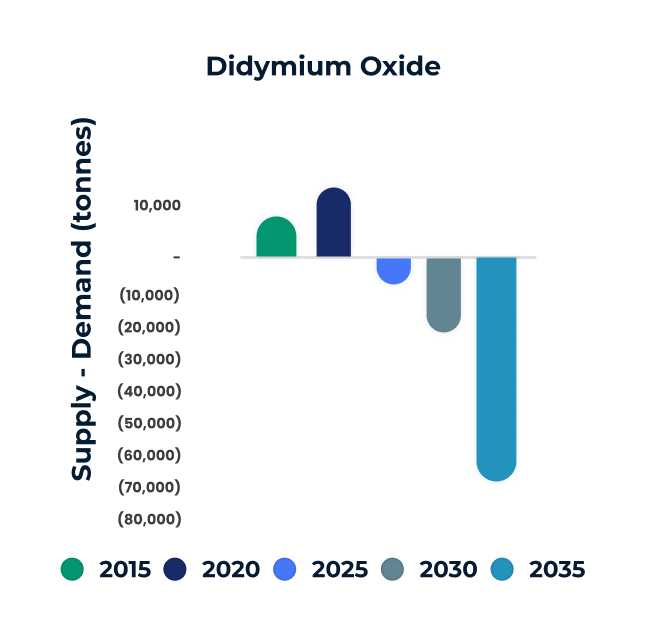

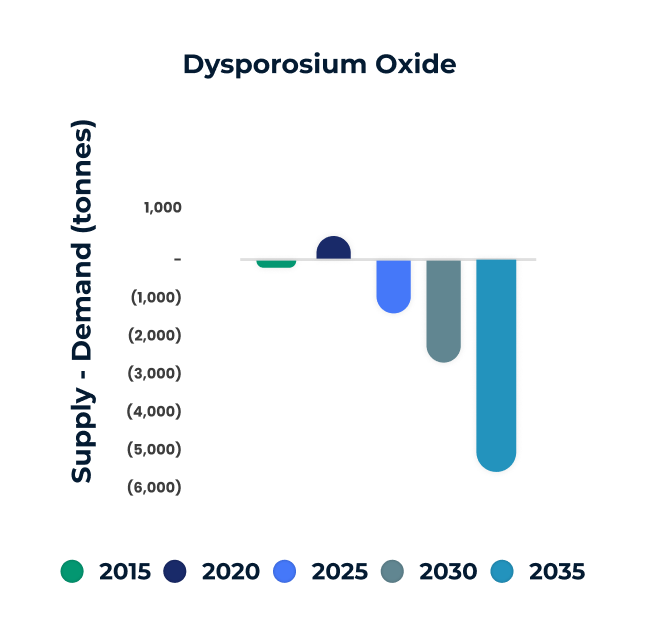

Not only does demand for neodymium, praseodymium, dysprosium and terbium make up the lion’s share of global value today, but in the years ahead demand for these four rare earth elements is expected to grow faster than demand for all other rare earth elements, challenging the ability of the supply-side to keep up.

As shown in Figure 8, Adamas Intelligence forecasts that global annual demand for didymium (neodymium-praseodymium) oxide and dysprosium oxide (or oxide equivalents) will substantially exceed global annual production by 2025, leading to the depletion of historically accumulated inventories and, ultimately, shortages ofthese critical magnet materials if substantial additional sources of supply are not developed.

FIGURE 8 : The supply-side will struggle to keep up with rising demand for neodymium and dysprosium.

Source: Adamas Intelligence research.

Subscribe

Subscribe

Members

Members